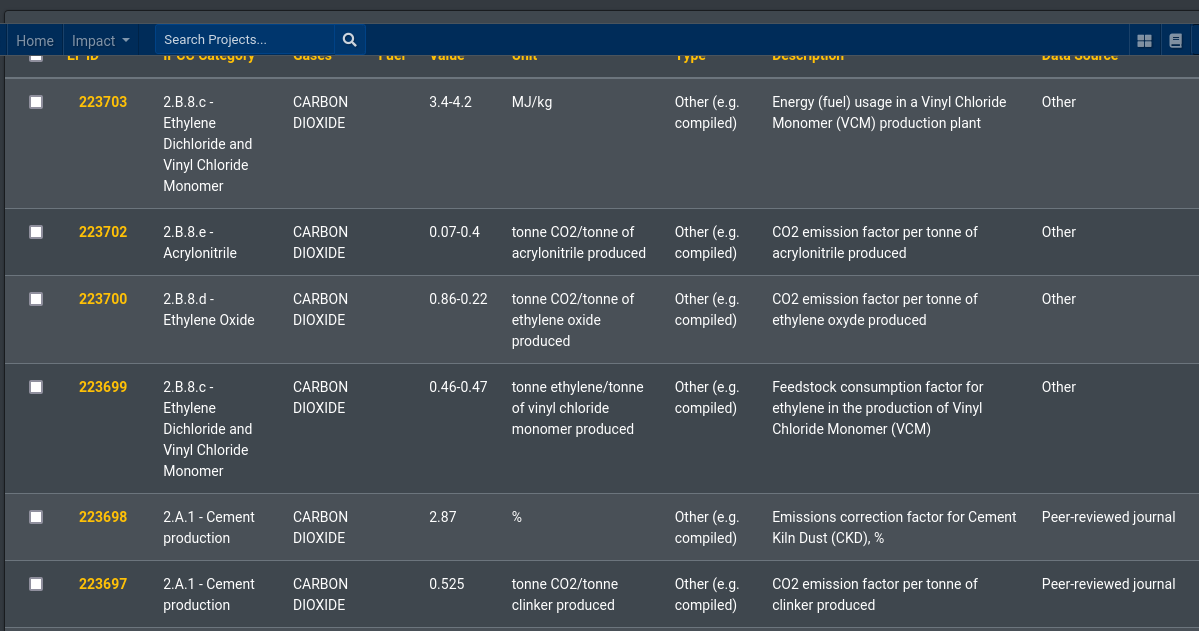

Integrating the IPCC Emissions Factors Database Into Equinox

In the latest update of the Equinox Project we discuss the integration of reference data an in particular greenhouse gas emissions factors as catalogued in the IPCC Emissions Factors database (EFDB).

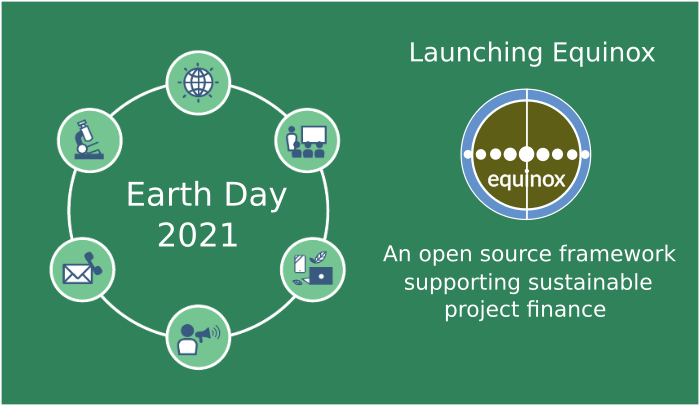

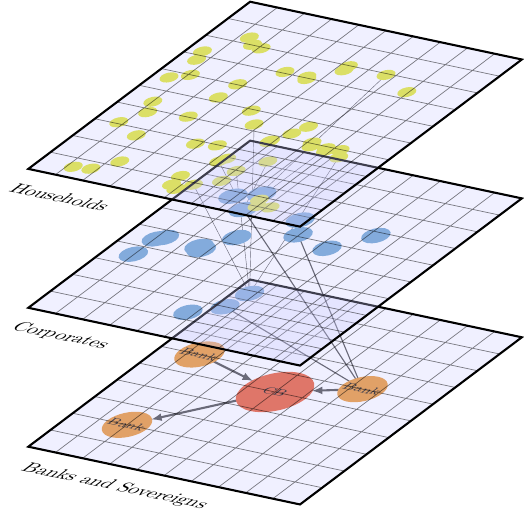

Equinox is an open source platform that supports the holistic risk management and reporting of major sustainable finance projects (the financing of projects with material physical footprint) such as project finance.

Equinox aims to integrate in the database a number reference databases that facilitate tasks of sustainable portfolio management. In the current focus such reference material concerns the emissions factors for various processes and activities. In the latest (Solstice Day!) update of the Equinox Project we discuss the integration of reference data an in particular greenhouse gas emissions factors as catalogued in the IPCC Emissions Factors database (EFDB).